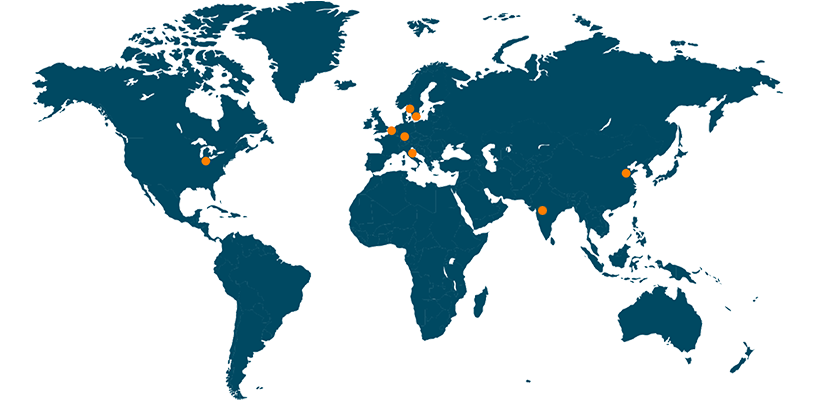

Locations

Perstorp is the operator of 8 production units in Asia, Europe and North America. Sales representation in three different regions. This, together with sales offices in all major markets and more than 50 agents, safeguards a global presence

Production units

- Bruchhausen, Germany

- Castellanza, Italy

- Perstorp Sweden

- Stenungsund, Sweden

- Toledo, the US

- Waspik, the Netherlands

- Zibo, China

- Sayakha, India

Find the most relevant sales representation for your region here >>